Diverse Perspectives Shape Fiscal Year 2026 Tax Policy

In a contentious yet ultimately unanimous vote, the Reading Select Board approved a shift in the town’s FY26 tax classification, increasing the commercial tax rate and slightly easing the residential burden. The decision followed a lengthy public hearing on November 4th, where residents, business owners, and board members debated the fairness and implications of adjusting the town’s split tax rate.

The approved change moves the residential factor to 0.990861, effectively increasing the commercial tax rate from a factor of 1.11 to 1.14. Compared to last year, this adjustment is expected to result in an average $184 increase for residential taxpayers ($10.97 per $1000) and an approximate $1,116 increase for commercial property owners ($12.56 per $1000), though the impact varies based on property value.

Board members were divided on how aggressively to pursue the shift. Select Board member Karen Gately-Herrick advocated for a move to 1.2 or 1.21, citing the need for fairness and equity in sharing the town’s financial responsibilities. Karen Rose-Gillis expressed concern about the lack of a strategic approach to increasing the tax rate:

I kind of think what we’re missing is a strategy for increasing the rates and not jumping from 1.11 to 1.2 or 1.21 in one year.”

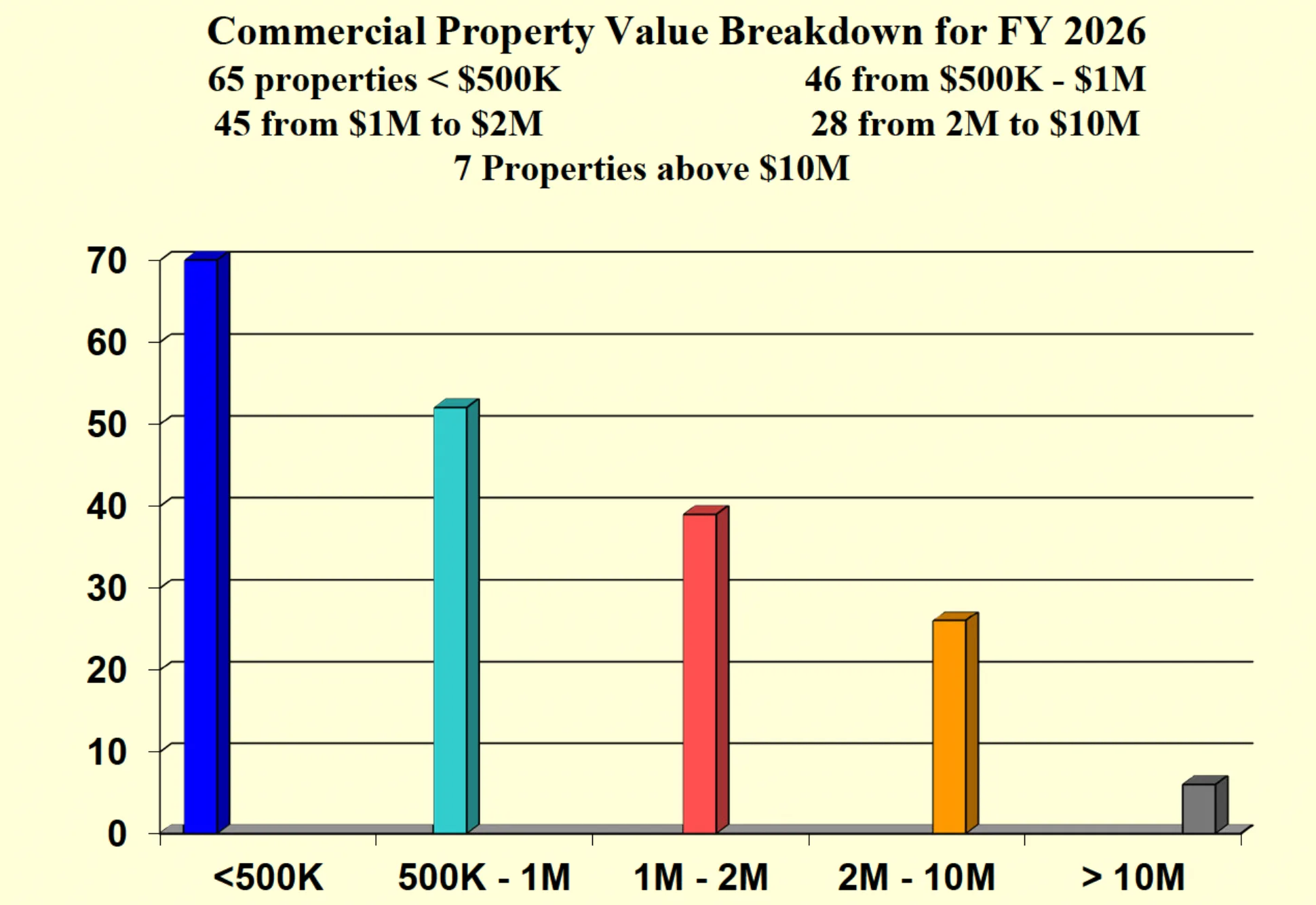

Others, including Select Board member Melissa Murphy, expressed concern about the impact on small businesses. “Our small businesses are local sole proprietors. They’re not big corporations,” Murphy said, advocating for a more modest increase to 1.12 to avoid overburdening local entrepreneurs. Reading has only 191 commercial properties, as shown in the chart below, with more than half valued at under $1 million.

Public comment reflected the community’s divide. Small business owners like Carlo Bacci and Bobby Botticelli urged the board to maintain the current rate or implement only minimal increases, citing economic uncertainty and rising operational costs.

Every increase hurts,” Bacci said. “We have to pass it on to the consumer.”

Conversely, residents like Anthony Darezzo contended that major commercial property owners should shoulder a larger portion of the tax load. “We can’t keep allowing big corporations to shield themselves behind small local businesses,” Darezzo stated, noting that a few high-value properties represent a substantial share of the town’s commercial tax revenue. However, Massachusetts’ Uniformity Requirements mandate equal and proportional taxation within each property class, prohibiting any favoritism based on business size.

Ultimately, the board settled on a compromise rate of 1.14, with members acknowledging the need for a long-term strategy to gradually shift the tax burden more equitably. The vote required 3-0 unanimity due to the absence of two board members, Chris Haley and Carlo Bacci, who recused themselves from the discussion due to the potential appearance of a conflict of interest. The board also voted not to adopt open space, residential, or small commercial exemptions for FY26, citing limited impact and outdated legislation.

The new tax classification will take effect in the upcoming fiscal year, with the town’s assessor and finance team preparing the necessary documentation for state certification. The board emphasized the importance of stability and transparency in future tax decisions, especially with anticipated debt exclusions for the new Killam School and ReCal expected to impact tax bills in FY27.