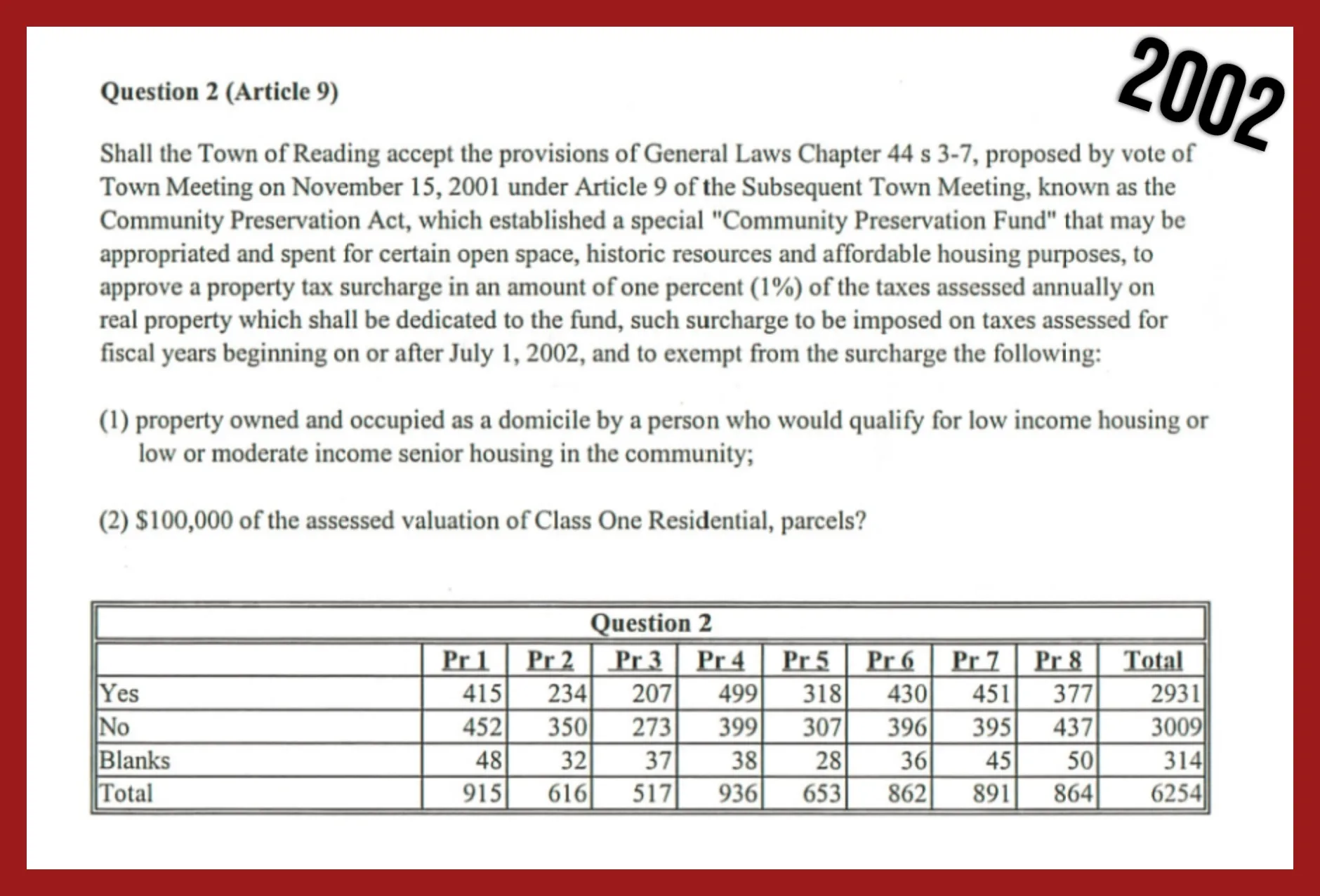

After months of careful deliberation, the Ad Hoc Community Preservation Act (CPA) Study Committee voted unanimously on Monday night to recommend a 1% CPA surcharge on local property taxes, paired with targeted exemptions designed to protect vulnerable residents. The decision represents a significant step forward in Reading’s renewed effort to bring the Community Preservation Act to the ballot after failing back in 2002 by just 78 votes (image below).

The committee’s recommendation will now move to the Select Board for consideration, with the goal of placing the measure on the April 2026 Town Meeting warrant and ultimately on the November 2026 state election ballot.

Key Votes and Rationale

Committee members agreed that a 1% surcharge strikes the right balance between generating meaningful revenue and minimizing taxpayer burden. At current property values, the surcharge would cost the average homeowner about $95 per year, while unlocking additional state contributions projected to bring total annual CPA revenues to over $1 million.

“This is a modest investment that opens the door to millions in matching funds and countless community benefits,” said Chair Joe Carnahan. “It’s a way to fund projects we’ve historically struggled to afford—without relying solely on overrides.”

Approved Exemptions

To ensure fairness, the committee endorsed three major exemptions:

- First $100,000 of residential property value

- Full exemption for low-income households

- Full exemption for low- and moderate-income seniors

“These exemptions are critical,” noted member Sandy Matathia. “They protect residents who can least afford additional taxes while still allowing the community to benefit from CPA funding.”

Commercial Properties Exempted

In a separate vote, the committee recommended fully exempting commercial and industrial properties from the surcharge. Members cited the relatively small revenue impact—about $51,000 annually—and concerns about burdening local businesses already facing economic pressures.

“It’s not worth the political fight for such a small gain,” said member Catherine Kaminer. “The benefits of CPA primarily accrue to residents, so this approach makes sense.”

Next Steps

The committee will finalize its report in mid-December and present it to the Select Board in January. If approved, the proposal will head to Town Meeting in April, where members will vote on whether to place the CPA adoption question on the November ballot.

If passed by voters, CPA funds could support projects in open space, recreation, historic preservation, and affordable housing—areas where Reading has long faced unmet needs.

To read more from the CPA Committee, visit their official page on the towns website here.