Senior Relief, Property Values, and Business Impact

At Tuesday night’s Select Board meeting, Reading Assessor Victor Santaniello delivered a comprehensive preview of the town’s Fiscal Year 2026 Tax Classification, outlining key decisions facing the board and highlighting the impact of Reading’s senior tax relief program.

Santaniello began by explaining the four actions the board must take during the upcoming tax classification hearing: selecting a Minimum Residential Factor (MRF), determining whether to grant an open space discount, considering a residential exemption, and evaluating a small commercial exemption.

Senior Tax Relief: A Community Commitment

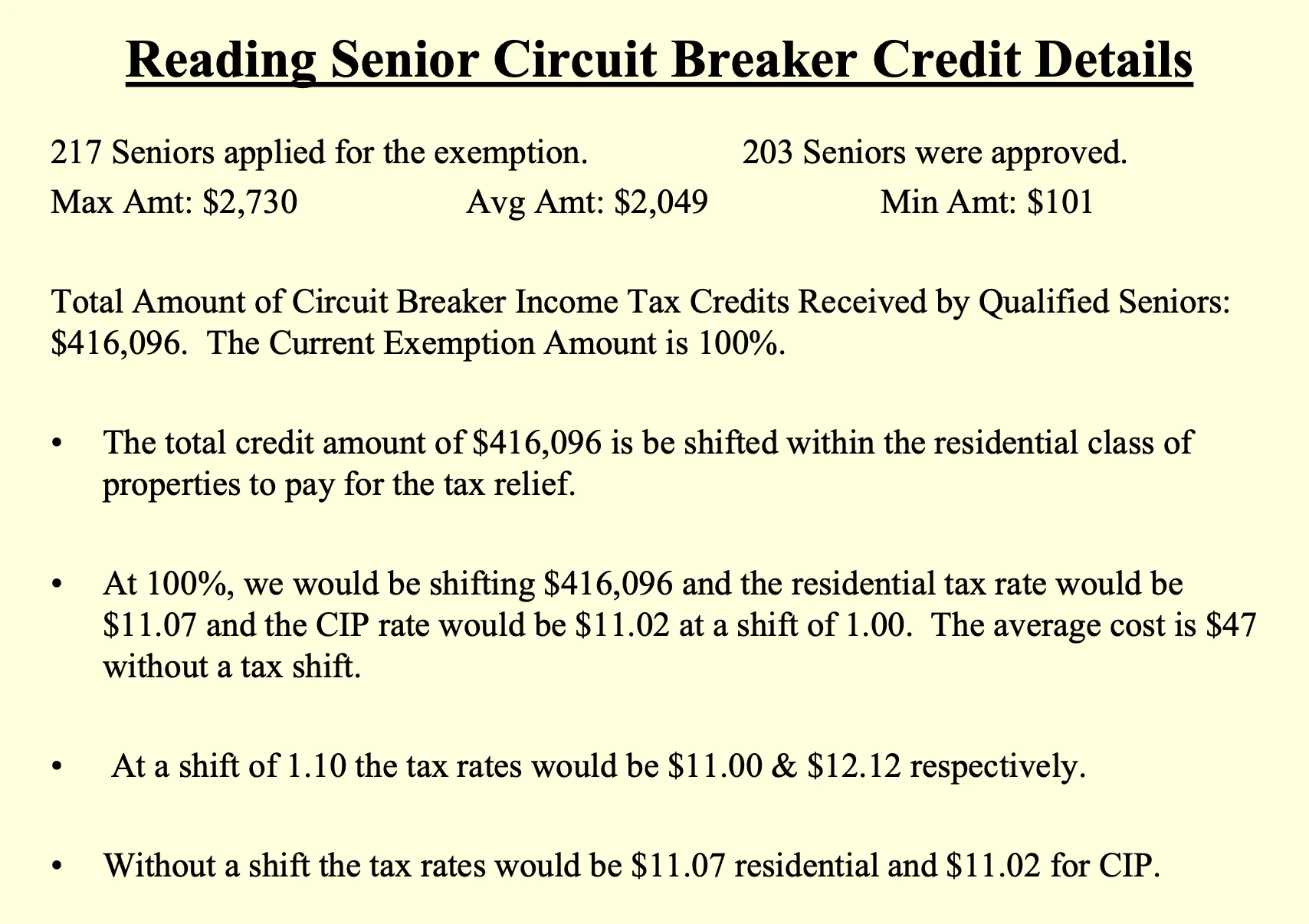

A focal point of the presentation was Reading’s “groundbreaking and innovative” senior tax relief program, which Santaniello praised for its effectiveness in helping older residents remain in their homes. In FY26, 217 seniors applied for the circuit breaker exemption, with 203 approved. The average exemption granted was just over $2,000, with the highest at $2,730.

To fund this relief, Reading employs a slight shift in its tax rate, increasing the residential rate while decreasing the commercial rate. Santaniello noted that this year’s proposed shift of 1.10 would result in a residential tax rate of approximately $11.00 and a commercial rate of $12.12. The average single-family home, valued at $944,000, would see a tax bill of just under $10,400.

This shift costs the average homeowner about $47,” Santaniello said, “but it helps over 200 seniors age in place and remain vibrant in our community.”

Property Values and Market Trends

Santaniello reported that residential sales in 2024 outpaced those in 2023, with days on market dropping from 34 to 26. However, the average sale price dipped slightly, which he attributed to fluctuations in available housing stock.

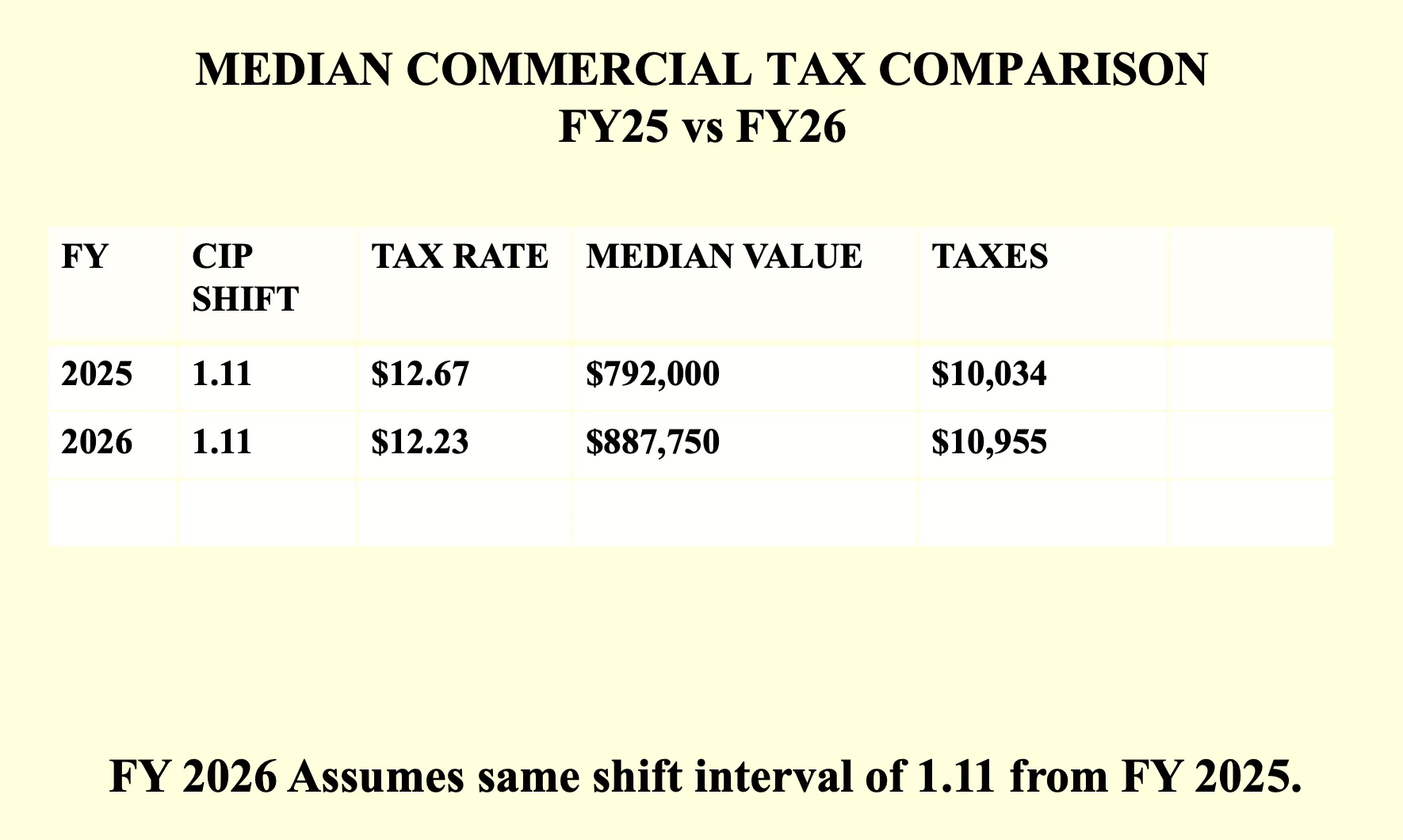

Commercial property valuations also saw changes, with the average value rising to just over $2 million. The median commercial property value stands at approximately $888,000. Santaniello emphasized Reading’s historical sensitivity to small business owners and cautioned against dramatic shifts in the tax rate that could burden local shops and restaurants.

Exemptions and Comparisons

Santaniello recommended against adopting a residential exemption, noting that it would disproportionately benefit lower-valued properties at the expense of higher-valued ones—a model more suited to cities like Boston and Chelsea with large numbers of investor-owned units.

Similarly, he advised against implementing a small commercial exemption, citing its limited applicability and the administrative burden of verifying eligibility. “We already throw a lot at our tax rate,” he said, referencing the senior relief program and the residential-commercial shift.

For the first time in over a decade, FY26 will carry zero debt exclusion impact, meaning no additional tax burden from major capital projects. The Killam and ReCal projects are not expected to hit the books until FY27.

Regional Context and Stability

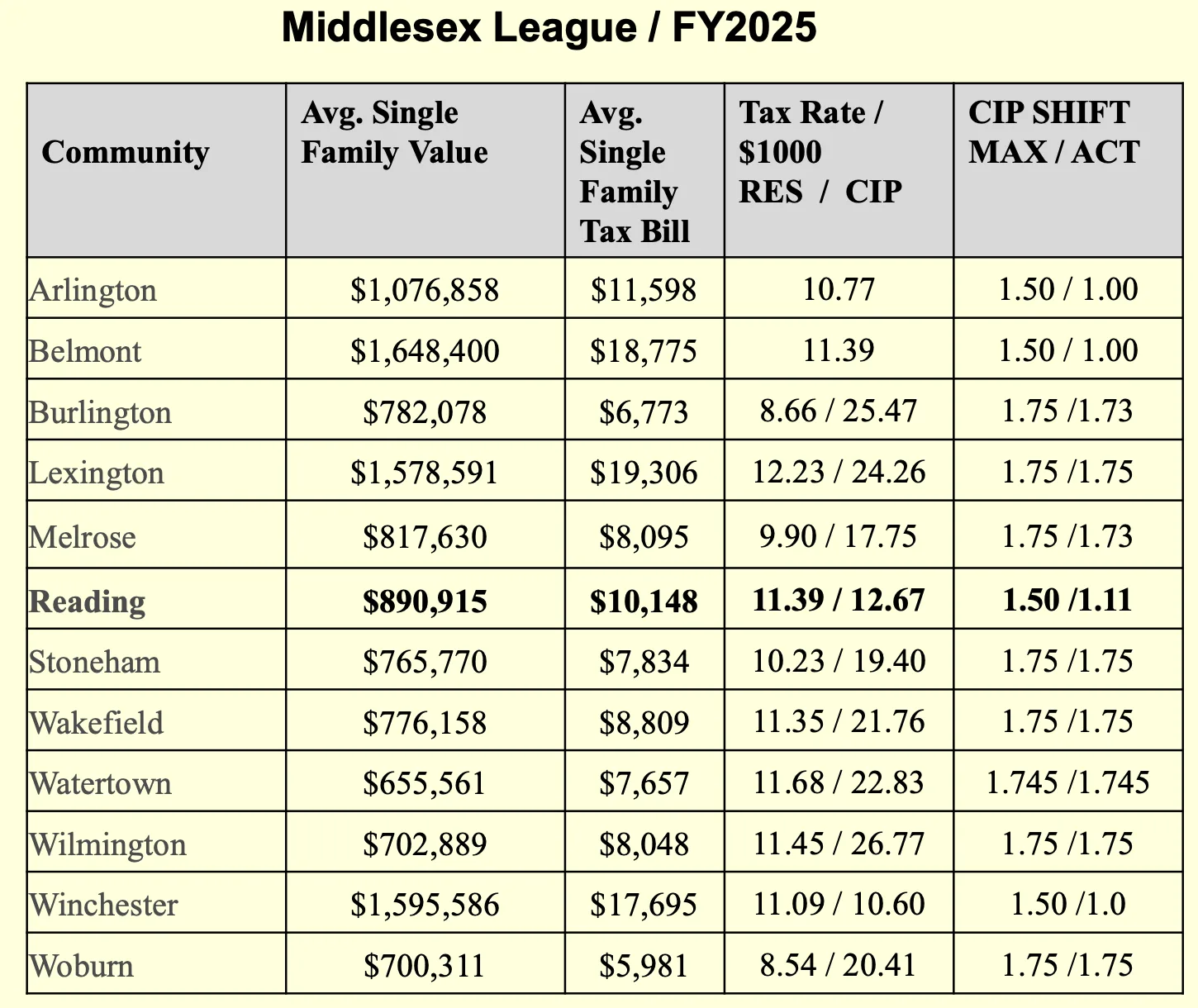

In comparing Reading to neighboring communities, Santaniello highlighted that towns like Wakefield, Wilmington, and Woburn routinely adopt the maximum allowable tax shift of 1.75. Reading, by contrast, has maintained a conservative approach, with last year’s shift at 1.11.

He urged the board to avoid drastic changes, warning that significant shifts could lead to increased abatement applications and instability.

Slow and steady,” he advised. “Move one or two points either way. It’s absorbable. Anything beyond that creates tremendous discord.”

Community Dialogue and Next Steps

The presentation sparked thoughtful discussion among board members and residents, with some advocating for greater relief for residential taxpayers amid concerns about a potential operational override in FY26. Others emphasized the need to protect small businesses from additional tax burdens.

Resident Chris Haley, who recused himself from speaking as a board member, noted the limitations of the small commercial exemption and shared that a public hearing by Joint Committee on Revenue on the issue is scheduled for November 7 at the State House.

If we can get this passed statewide, it would allow communities like Reading to better support our mom-and-pop shops,” he said.

The official tax classification hearing for the Select Board is scheduled for November 4th, where the board will vote on the FY26 tax rate and related exemptions.